Introduction to Contribution Margin

In the world of online businesses, understanding your contribution margin is a powerful key to success. It involves much more than just factoring the cost of your product. It requires considering other variable costs related to selling the product, including shipping, transaction fees, fulfillment costs, and advertising.

Put simply, the contribution margin is the net revenue generated minus all variable costs. Yes, operational expenses are key to determining profitability, but understanding the margins before these operating expenses come into play is equally important.

Crunching the Numbers: A Detailed Example

To illustrate this better, let’s take a detailed example:

Suppose we generate a revenue (ex VAT) of €70 and encounter the following variable costs:

- Product Cost: €20

- Transaction Cost: €1.60

- Shipping Cost: €4.20

- Fulfillment Cost: €2.10

- Packaging Cost: €0.50

- Advertising Cost (CPA): €18

- Total Variable Costs = €46.40

The contribution margin is then calculated by subtracting the variable costs from the revenue generated, which leaves us with €23.60 (€70 – €46.40).

Scaling Up: Examining the Contribution Margin’s Role in Growth

Understanding your contribution margin opens up opportunities for fine-tuning your business, reducing unnecessary costs, and ultimately increasing profitability. Let’s illustrate this with an example:

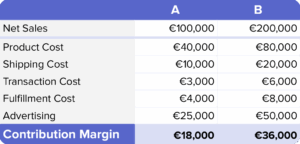

Let’s imagine a brand that achieves €100,000 in sales per month. The expenses for this brand are spread across different aspects of the business:

- €40,000 on the product

- €10,000 on shipping

- €3,000 on transaction fees

- €4,000 on fulfillment

- €25,000 on advertising

When we subtract these costs from the total sales, we get a contribution margin of €18,000.

Now, let’s envision a situation where this brand’s sales double to €200,000. If the business can maintain the same percentage for each type of expense, the new expenses would look like this:

- €80,000 on the product

- €20,000 on shipping

- €6,000 on transaction fees

- €8,000 on fulfillment

- €50,000 on advertising

In this scenario, the contribution margin would rise to €36,000.

While the contribution margin doesn’t factor in operational expenses, it remains an essential metric. In the scenarios above, assuming consistent operational expenses of €10,000 each month, net profit leaps from €8,000 to €26,000 – quite an increase!

Scaling Up: Leveraging Business Growth for Better Bargaining Power

As your business expands, it does not just become more operationally efficient—it also gains increased bargaining power. This enhanced leverage can lead to improved payment terms across different aspects of the business, substantially impacting your bottom line. For instance, with higher sales volumes, you could negotiate for lower product costs with suppliers, or secure volume discounts from fulfillment providers. Even transaction and shipping costs can be negotiated down with increased volume, as payment processors and logistics providers often offer lower fees or tiered pricing for businesses with higher transaction volumes.

These improved terms and operational efficiencies all contribute to a higher profit for your business. However, these savings aren’t automatic—they require active negotiation and a strategic approach. But the potential for increased profitability makes this effort worthwhile. As your business grows, always be ready to seize opportunities to optimize costs, understand your contribution margin, and steer your business toward sustained, profitable growth.

Growth and Efficiency: Understanding Operational Expenses

As your business expands, your operational expenses may increase as well. However, they might not rise at the same rate as your total revenue. For instance, if your business doubles in revenue, certain fixed costs like rent, rates, and insurance will likely stay the same.

Additionally, if you maintain the same number of staff throughout the year, despite peak sales periods, your current use of labour isn’t as efficient during non-peak times. So, if your sales double, your staff costs won’t necessarily follow suit, leading to greater operational efficiency. That means your business is becoming more efficient—a key aspect of managing growth and increasing profits.

Marketing Efficiency: Balancing Spend for Optimal Returns

As your business grows, your marketing efficiency might naturally decrease, but don’t worry— this is normal. To navigate this, we can use metrics like the Marketing Efficiency Ratio (MER), which is calculated by dividing Net Sales by the total amount spent on marketing.

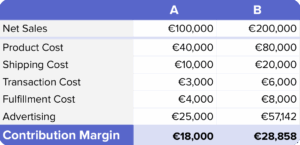

Consider the following example: in both cases where the brand was generating €100,000 and €200,000, the marketing efficiency ratio was 4. This ratio is calculated as Net Sales divided by Marketing Spend.

However, as you increase your advertising spend, it generally becomes less efficient. For instance, if your marketing spend doubles, and this results in an efficiency decrease of 12.5%, your new MER would be 3.5 (a reduction from 4).

To calculate this, you’d take the new Net Sales figure of €200,000 and divide it by the MER of 3.5, resulting in a new marketing spend of €57,142. While your marketing spend has increased, and the efficiency has decreased, the total contribution margin generated for the business is still significantly higher, enhancing overall profitability.

Conclusion: Harness the Power of Contribution Margin for Business Growth

In conclusion, understanding your contribution margin can significantly help you fine-tune your operations, bolster your profits, and navigate growth more effectively. So, make the most of your contribution margin knowledge, and set your online business on the path to sustained success.

Get started with a 14 day trial

At StoreHero, we’re building the future of e-commerce. Get a demo with our expert team and see how StoreHero can supercharge your growth.