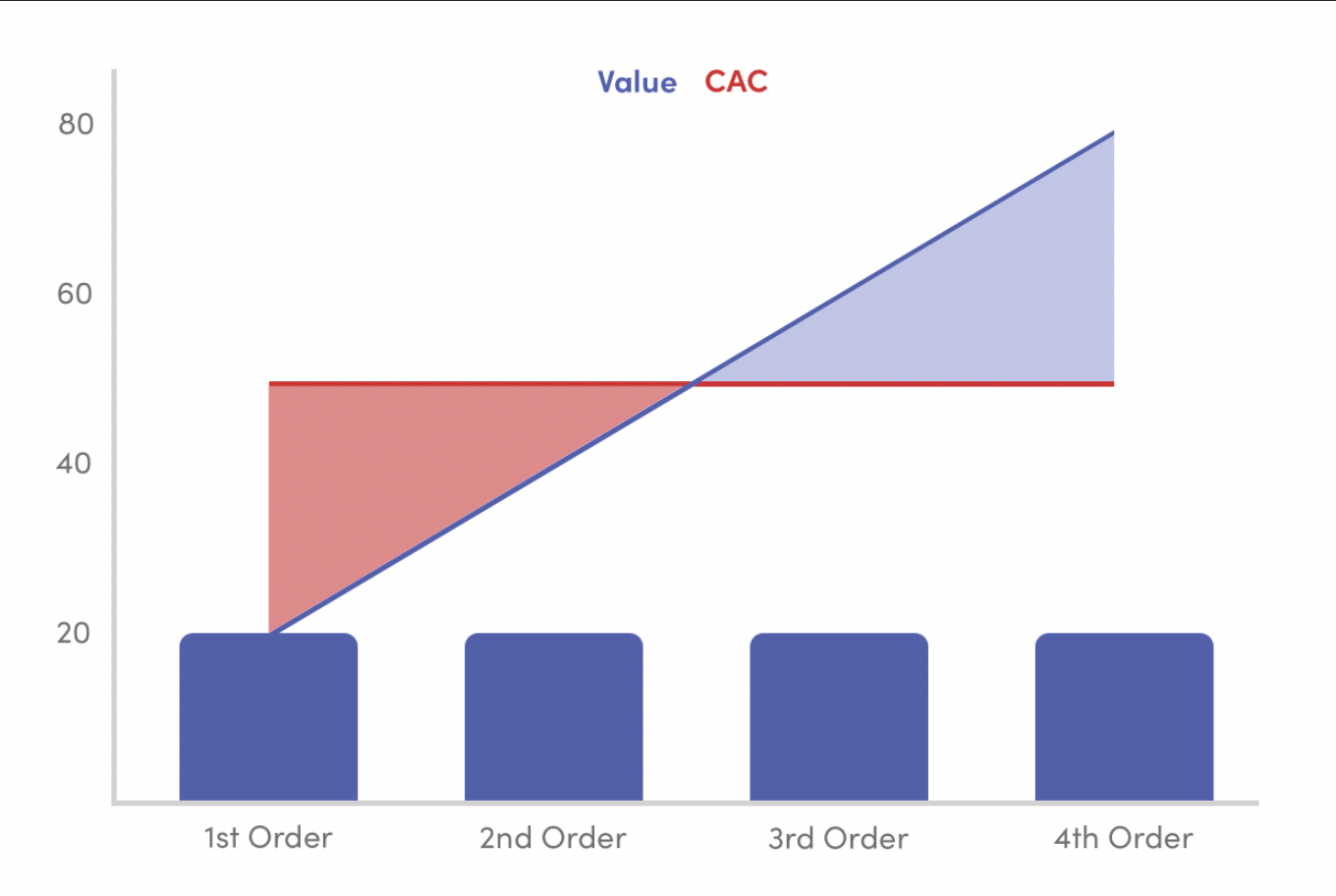

As you start to grow and scale your business, cashflow becomes vitally important for your business. The CAC payback period is also a crucial metric for businesses to consider. The CAC payback period is the length of time it takes for a business to recoup the cost of acquiring a new customer through their customer’s lifetime value. For ecommerce businesses, profitability on the first order may not always be necessary. Depending on industry and product nature, businesses may prioritize a longer CAC payback period to achieve long-term profitability.

By understanding their CAC payback period, businesses can make informed decisions about their customer acquisition strategies and ensure that they are not overspending on customer acquisition.