Profit-First New Customer Offers

In this guide, we’ll break down how to build profitable new customer offers that scale sustainably.

You’ll learn how to:

✅ Design new-customer offers that actually make money

✅ Measure them using CAC Payback, Gross Profit per New Customer, First Order Margin, and Retention Rate

✅ Use StoreHero to spot which offers are truly driving profit, not just sales.

TL;DR:

Most brands think growth means more discounts or higher ROAS.

Smart brands know it’s about faster payback, higher margins, and repeat buyers.

This guide shows you exactly how to build offers that do all three.

How to design, measure, and optimize your first-purchase offers through the StoreHero lens

Most DTC brands use “new customer offers” to drive short-term acquisition. But for many, the real outcome isn’t growth, it’s margin erosion.

We see it every day:

“20% off your first order!”

“Free shipping on your first purchase!”

These offers move volume, but they don’t move profit.

The smartest brands have learned a different approach: build offers around CAC payback and Gross Profit per new customer – not just conversion rate.

And that’s where StoreHero changes the game. This isn’t about guessing which offer works best; it’s about knowing which one delivers profitable growth.

Think in Two Buckets: New vs Returning Customers

Before we dive in, here’s a mindset shift every brand needs to make.

Your business really operates in two buckets:

- New Customers – the lifeblood of future growth.

- Returning Customers – the engine of today’s stability.

If you blend these together in your reporting, you’ll get mixed signals about the health of your business.

For example:

If revenue is modestly up, but new customers are down 20% and returning customers are up 20%, that’s not a healthy story. It means your growth is being propped up by repeat buyers, while the top of your funnel is quietly drying out.

In the short term, that’s survivable. In the long term, it’s dangerous, because you’re slowly squeezing the sponge dry.

As a DTC operates it’s important that you separate these two customer types, helping you see whether your growth is coming from new acquisition, retention, or both, and how profitable each engine truly is.

The Misconception That’s Killing Growth

Many brands still believe eCommerce is a game of who can get the lowest CAC or the highest ROAS.

It’s not.

Let’s face it, ad costs are only going up. According to Meta’s recent earnings report, the average price per ad increased 10% year-over-year.

If your growth strategy depends on finding ever-cheaper CACs in a world where costs are rising, you’re setting yourself up for decline.

The brands we see truly scaling, think differently. They’re not chasing the cheapest CAC or highest ROAS.

They’re engineering profitable acquisition through smart, well-structured new-customer offers that hold up even when ad prices climb.

Because when you design your new customer offer around profit, not price, you can push harder, scale faster, and grow sustainably, even as ad costs rise.

Why Most New Customer Offers Don’t Scale

Here’s the uncomfortable truth: most brands never give themselves enough margin on the first order to actually afford to grow.

Let’s take two brands selling the exact same product – say, $50 t-shirts to 25-year-old men in the U.S.

Brand A loves to discount. They give 20% off, throw in free shipping and easy returns — anything to boost conversion.

Brand B takes a different route. They protect price, charge shipping for most (not all) customers, and use discounts sparingly.

Now, look at what happens under the hood 👇

| Metric | Brand A | Brand B |

|---|---|---|

| RRP | $50 | $50 |

| Discount | 20% | 0% |

| Net Sales | $41.67 | $50 |

| Full COGS (incl. shipping) | $17 | $12 |

| Gross Profit % | 49.3% | 76.0% |

| Breakeven CAC | $24.67 | $38.00 |

| Breakeven ROAS | 1.69 | 1.32 |

Brand A’s “conversion-boosting” tactics slash their Net Sales and inflate costs through free shipping. Discount drops revenue, and free shipping/returns increases COGS – Massive increase in margin pressure!

Brand B keeps discipline, holds margin, and ends up able to afford to spend 55% more on CAC while staying breakeven.

That’s HUGE!

In a world where ad prices are climbing (Meta’s average price per ad rose 10% YoY), who do you think has the margin to keep scaling? When you protect margin, you buy flexibility. You can afford higher CACs, test broader audiences, and out-compete discount-driven brands whose economics collapse the moment costs rise.

It’s tempting to lean on discounts, free shipping, or “limited-time” incentives to juice conversions. But every time you do, you shrink the cash you have to reinvest in growth.

So ask yourself:

If you could afford a CAC that’s 55% higher than today, how much harder could you scale?

That’s the compounding power of margin. And it’s exactly what StoreHero helps you quantify, every day. Once you understand your CAC payback and gross profit, you can start designing profitable new customer offers that scale.

3 Primary Culprits

Most first-purchase offers fail for one of three reasons:

- They attract the wrong customer – Discount hunters don’t stick. They buy once and churn.

- They ignore true unit economics – ROAS might look great, but once you layer in discounts, shipping, and ad costs, profit disappears.

- They aren’t measured beyond day one – Offers are often judged on CTR or CPA, not on CAC payback, Contribution Profit, or long-term margin impact.

💡 StoreHero Insight:

When we map product data to profit, we regularly find “top-performing” offers that actually lose money per customer once acquisition costs are factored in.

The Four Metrics That Matter

Every profitable offer decision in StoreHero comes back to four key metrics:

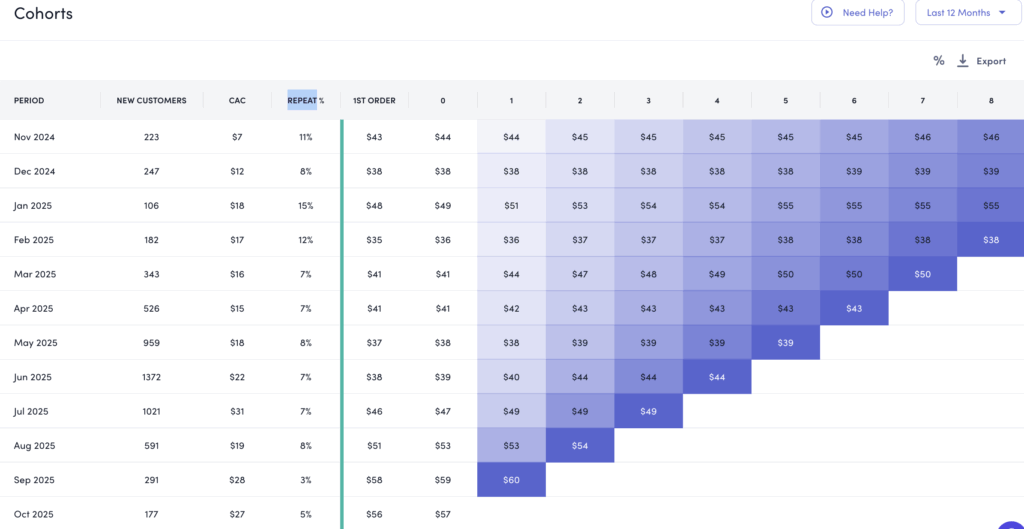

1. CAC Payback Period

What it tells you:

How long it takes to recover your acquisition cost through profit.

Where to see it:

StoreHero → LTV → Cohorts

If your “15% off” offer extends CAC payback from 60 → 90 days, that’s a warning sign. You’re using more cash per customer and waiting longer to see return. More on how to measure Customer Lifetime Value and CAC payback here.

What to do:

You’ve got two paths depending on your position:

- If you’re pretty heavily first-order profitable but can’t scale:

Spend more. If LTV supports it, there’s no point in being overly efficient at the expense of growth. - If CAC is rising and margins are tightening:

Adjust your offer to lift AOV or retention instead of discounting deeper.

For example, “Free gift over €80” can shorten payback by boosting order value without hurting margin.

If you’d like more help on understanding this chart, check out our Co-Founder, Karl O’Brien, explaining the cohort matrix!

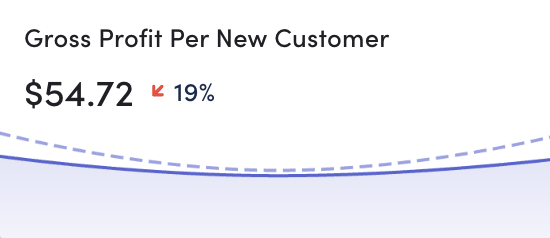

2. Gross Profit per New Customer

What it tells you:

The true profit earned from each new customer after every COGS item, including product costs, discounts, returns, free shipping, 3PL, and transaction fees.

Where to see it:

StoreHero → Store Overview→ Gross Profit per New Customer

Imagine two offers:

- Offer A (20% Off) → $11 GP per new customer

- Offer B (Free Gift) → $28 GP per new customer

Same ad spend, same conversions, but completely different outcomes.

If it costs $20 to acquire a customer, Offer A loses money on day one, while Offer B is profitable from the first purchase.

What to do:

When building a new customer offer, design it to maximize Gross Profit per New Customer at a scalable CAC. Competing too aggressively on price might boost conversions but often leaves no room for rising ad costs.

Focus on perceived value over discount depth, and find ways to lift AOV or contribution margin instead.

(For more ideas, check out our post on Three Levers for Margin Expansion.)

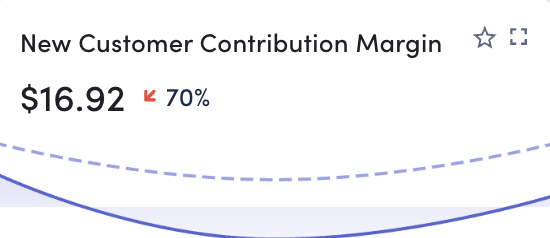

3. First Order Margin (New Customer Contribution Margin)

What it tells you:

Your profit margin on a customer’s very first purchase, before any repeat orders or retention effects come into play.

Formula:

New Customer Gross Profit – CAC = New Customer Contribution Margin (NCCM)

Where to see it:

StoreHero → Store Overview

Do I need to be first order profitable?

This simple equation shows whether you’re first-order profitable. In other words: are you acquiring customers for less than the gross profit they generate on that initial order?

If the answer is yes, you can scale confidently. If no, you’re relying on future orders (LTV) to make your ROAS/CAC numbers work, and that’s a risk if retention dips or costs rise. For some brands it’s part of the strategy!

NCCM is one of the most powerful levers in eCommerce because it instantly tells you whether your acquisition model is scalable, or fragile.

If your NCCM is negative, that’s not always bad, but it means you must know your CAC Payback window. If you’re not recovering that loss quickly, and you start scaling spend, you’re effectively scaling a hole in your P&L. Many brands run into cashflow crunches by chasing growth without payback visibility.

If your NCCM is strongly positive, that’s great, but it may also be a signal that you’re being too efficient – For more check out our blog on – MER & aMER: Smarter Metrics Than ROAS . Look at your LTV expansion over the first 30–90 days. If retention is strong, you might have room to spend more, lower NCCM slightly, and drive far higher new customer volume without hurting profitability.

Why it matters:

NCCM underpins how aggressive you can be with acquisition. It’s the difference between controlled growth and burning cash to buy topline. The best operators use NCCM to decide not just if they can scale, but how hard they can push.

4. Retention Rate %

What it tells you:

The percentage of new customers who come back, and how quickly they do so.

Where to see it:

StoreHero → Cohort Explorer → Returning Customer Rate by Offer Cohort

This metric shows the long-term health of your acquisition strategy. If your “discount-first” cohorts churn faster than your “value-first” cohorts, that’s not just a retention issue, it’s a growth trap. You’re attracting low-quality customers who cost money to acquire but don’t stick around long enough to pay you back.

Why it matters:

Improving retention takes pressure off your marketing engine and compounds profitability over time.

Let’s say your CAC is $20 and your First Order Margin is $25. You’re profitable on day one.

If your repeat customer rate is 15%, your first order profit grows 15% over 12 months:

→ $25 × 1.15 = $28.75 total margin per customer.

Now, if you lift that repeat rate to 50%, through better email flows, stronger post-purchase experience, or a stickier product — the impact compounds:

→ $25 × 1.50 = $37.50 total margin per customer.

That extra $8.75 in profit doesn’t just pad your margin, it gives you more room to spend on CAC and still stay profitable, because customers are coming back faster.

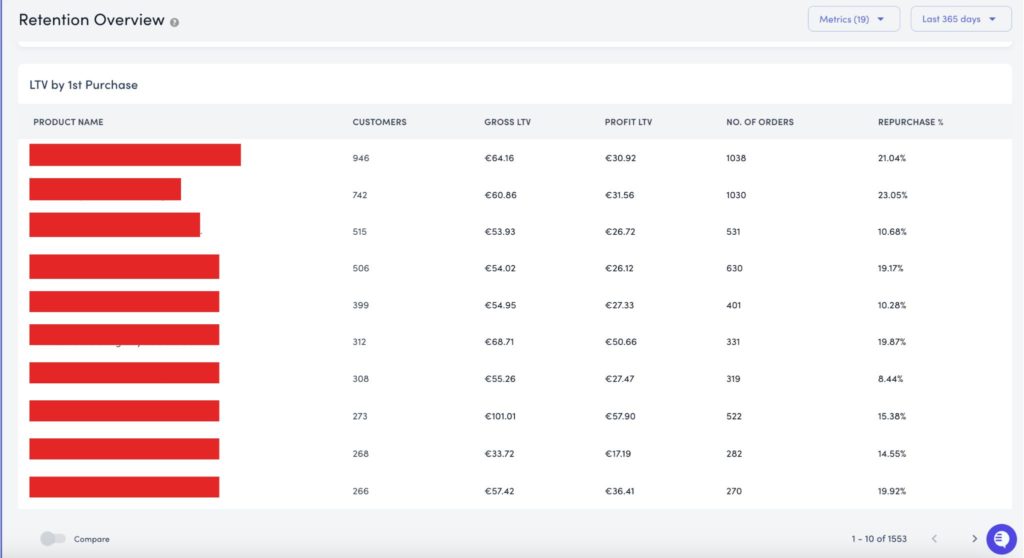

Digging Deeper: Retention by Product

If you want to unlock the why behind your retention rates, look at them on a product level.

Head to StoreHero → LTV → Overview, where you can see repeat customer rate by product.

- Feature more in creative – because they drive repeat purchases.

- Rethink or reposition – if they sell well but don’t bring customers back.

You might find that some of your top sellers aren’t actually your best long-term performers. They convert, but when they’re part of a new customer’s first order, those customers rarely return. That’s critical insight for shaping which products to promote and which offers to build around.

What to do:

Use StoreHero’s cohort and product-level retention views together to guide your creative and offer strategy. Push the products that not only sell – but compound.

More on how to use the Retention Overview here!

How to Build Profitable New Customer Offers (Using StoreHero Data)

Now that we’ve looked at how great brands structure offers for scalable growth, let’s break down how to design one yourself, using StoreHero as your decision compass. Before we dive in, a few assumptions: you’re not running a one-and-done product (like sofas or mattresses), and your products have a realistic repeat window. The best offers are built around products that combine:- High Gross Margin – the foundation for sustainable scaling.

- High Repeat Rate – often even more powerful than margin, especially for subscription or replenishment brands.

Balancing Discounts and Strategy

When designing your new customer offer, think of it as a balancing act between conversion and contribution margin. Here’s the framework top operators use:- Sitewide vs Segmented Offers Keep sitewide promotions broad and time-limited. Use more personalized or conditional offers (VIPs, bundles, aging stock) to drive specific outcomes without eroding overall margin.

- Discount Depth vs Timing Shallow discounts early in a campaign are healthy; reserve deeper ones for later stages — when CAC rises or you need to clear inventory.

- Avoiding the Margin Mirage A revenue spike doesn’t always mean success. Check Gross Profit per New Customer and CAC Payback to make sure your biggest offer days aren’t secretly your least profitable.

- Know Your Market Position Don’t discount like a mass brand if you sell a premium product. Communicate value and quality, not desperation.

Step 1: Start with Your Baseline

Head to StoreHero → Dashboard → Profit Snapshot and get clear on your starting point:- Gross Profit per New Customer

- CAC

- Average NCCM (New Customer Contribution Margin)

- Retention Rate

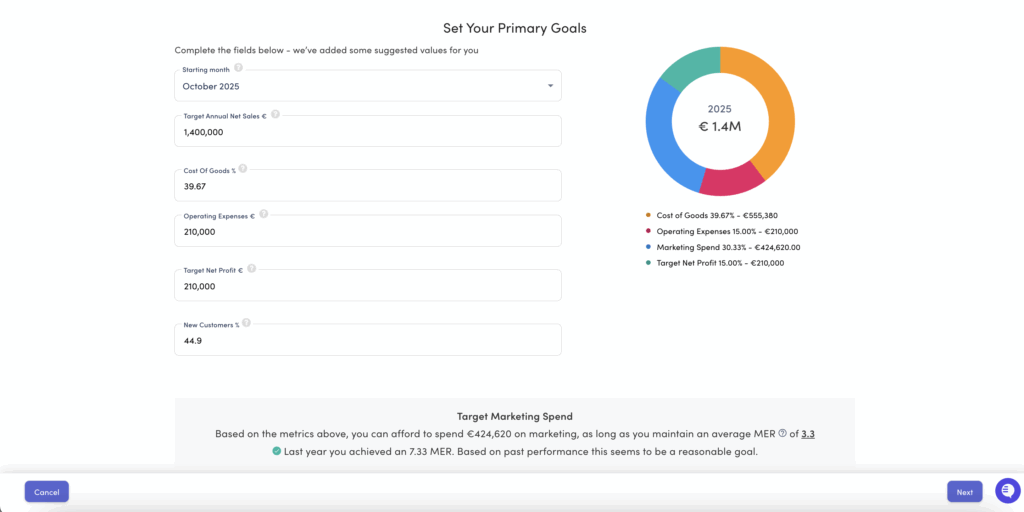

Step 2: Forecast the Impact

Instead of guessing how a new offer might perform, use StoreHero’s Forecast Builder (Ecommerce Forecasting: How to Forecast Ad Spend, MER & Profit Goals with StoreHero) to project how changes to your offer structure — like discount depth, free shipping, or general COGS changes — will affect profit, cash flow, and CAC payback. You can model different scenarios side-by-side to answer:- “If we drop from 20% to 10% off, how does our MER & spend levels change?”

- “What happens to total profit if retention improves by 10%?”

- “How much CAC headroom do we gain if AOV rises by €5?”

Step 3: Launch, Track & Iterate

Once you go live, StoreHero automatically groups new customers by the offer that converted them. Within 7–14 days, you’ll see cohort-level insights like:

-

Which customers are profitable on the first order

-

Which have fast CAC Payback

-

Which are leaking margin through over-discounting

That feedback loop turns offer creation into an iterative profit engine.

Step 4: Double Down on Winners

When you identify your best-performing offers, use StoreHero’s dashboards to push budget into what’s working and cut what’s not. The goal: every new customer contributes to profit within their first order or first 30 days.

The Takeaway

Every StoreHero brand uses data to refine profitable new customer offers that drive sustainable growth.

Because every profitable brand knows, real growth doesn’t come from lowering CAC, but from faster payback and higher contribution margin.

With StoreHero, you can see exactly which offers grow profit, not just revenue. 👉 Log in to StoreHero to see your own numbers or drop a message in the chat if you’ve got any questions!Profitable new customer offers are first-purchase incentives that attract customers while maintaining healthy margins. Instead of relying on deep discounts, these offers balance CAC, gross profit, and payback period to ensure you grow revenue and profit.

Start with your unit economics. Measure your Gross Profit per New Customer, CAC, and First Order Margin in StoreHero. Then test different incentives, like small discounts, free gifts, or shipping thresholds, to find which combinations deliver strong CAC payback and positive contribution margin.

Because brands often chase ROAS only instead of contribution. Heavy discounts shrink gross profit and extend CAC payback, which means you burn cash faster.

Profitable brands design offers around margin and retention, not just top-line growth.

It depends on your cash flow and retention cycle, but most healthy DTC brands aim to recover CAC within 30–90 days. If your payback period extends past 90 days, review your discount strategy and margin structure in StoreHero’s LTV dashboard.

Reduce COGS, (charge shipping costs, optimize fulfillment fees), and test incentives that lift AOV instead of cutting price.

For example, “Free gift over $50” often outperforms “15% off,” because AOV rises and margins hold steady. StoreHero helps you measure this impact per offer.

Retention turns a break-even offer into a profitable one. If your repeat customer rate improves from 15% to 50%, your profit per customer compounds fast, freeing up more budget to scale CAC. You can track this by product or cohort inside StoreHero → LTV → Overview.

There’s no one-size-fits-all. For most brands, small value-add offers (like free gifts, bundles, or shipping thresholds) outperform sitewide discounts over time. Use StoreHero’s Forecast Builder to model each option’s impact on payback and profit.

High CAC isn’t always the problem — not knowing your payback period is.

If your CAC Payback is under 60–90 days, a “high” CAC can still be healthy. It means you’re buying customers efficiently because they return quickly and generate profit.

But if CAC payback is extending beyond 90 days and your cash is getting tight, here’s what to do:

Check your First Order Margin (NCCM) – if it’s negative, you’re losing money upfront.

Lift AOV, don’t cut CAC – test “Free gift over €X” or tiered shipping thresholds instead of deeper discounts.

Fix your creative fatigue – stale ads often double CAC. Rotate creative weekly based on profitable audience data.

When growth stalls, most brands blame ads. But in 9 out of 10 StoreHero accounts, it’s profit flow, not traffic flow, that’s choking growth.

Here’s how to diagnose it:

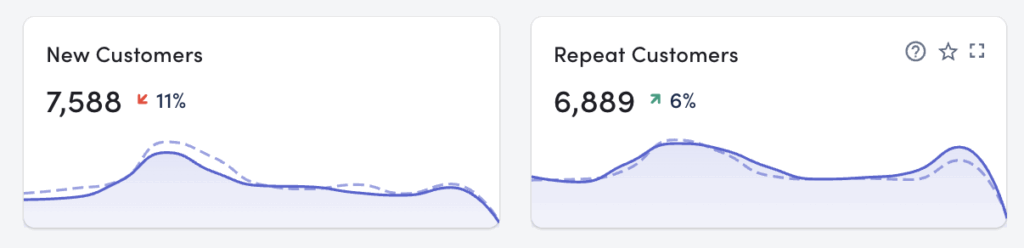

Split New vs Returning Customers — if returning is rising but new is falling, your top of funnel is drying up.

Check Gross Profit per New Customer — your growth can’t scale if each new customer costs more to acquire than they generate.

Look at Payback Period Trends — if it’s creeping up month by month, your offers are losing efficiency.

💡 Growth isn’t about more spend — it’s about faster return on spend. StoreHero’s dashboards show exactly where your funnel leaks profit, so you can plug it before scaling again.

Classic trap. ROAS measures revenue efficiency, not profit efficiency.

A 3x ROAS might look great — until you factor in:

Discounts that eat 15–20% of margin

Shipping and returns

Ad platform fees

COGS creep

That’s why StoreHero tracks MER, aMER, and Gross Profit per New Customer — they tell you what’s actually left after all costs.

👉 You don’t run your business on revenue, you run it on profit.

So stop measuring performance with a revenue metric (ROAS) and start using profit metrics that scale sustainably.

Not necessarily. Lowering discounts might improve margin but kill conversion. The smarter move is to rebalance offer structure:

Swap flat discounts for value-based offers (free gifts, bundles, or thresholds).

Raise AOV with tiered shipping — “Free shipping over €80” outperforms “10% off” almost every time.

Track how these changes affect Gross Profit per New Customer in StoreHero to confirm lift, not just conversion.