The Ultimate Guide to Subscription Economics for DTC Brands

Subscription-based ecommerce isn’t just a trend, it’s the most powerful, scalable, and resilient business model in DTC today. Look at the brands dominating the space: Huel, Athletic Greens, Grüns, and countless fast-growing supplement, wellness, and consumer goods companies. Their growth isn’t luck, it’s math.

Subscriptions transform one-time buyers into a predictable, compounding revenue engine. Instead of constantly battling rising CACs, seasonality, and volatility, subscription brands build a model where retention, margin expansion, and repeat revenue do the heavy lifting.

This guide breaks down the economics behind subscription businesses, the metrics that actually matter, and how the best DTC operators scale faster and more profitably, even while acquisition gets more expensive.

TL;DR | Why Subscription Brands Win in DTC

- Subscription revenue compounds, increasing LTV and lifting your CAC ceiling.

- Ad costs are rising, pushing one-time-purchase brands into hard growth limits.

- The most important metric isn’t CAC, it’s CAC payback window.

- Great subscription brands:

- Spend confidently, not cautiously

- Track gross margin expansion by cohort

- Scale into their CAC ceiling with intention

- Master these economics and you can scale predictably, even in a high-CAC environment.

What You’ll Learn in This Guide

By the end of this article, you’ll understand:

- Why subscription unit economics outperform one-time purchase models

- The core metrics that drive sustainable growth, including CAC, LTV, 1st order gross margin, and CAC payback

- How rising ad costs impact your CAC ceiling – and why subscriptions break that ceiling

- How to model your payback window and determine how aggressively you can scale

- The difference between first-order profitability and long-term profitability

- What great vs dangerous subscription economics look like using real-world examples

- How to operate like top DTC subscription brands – with predictable cohorts and compounding profit

- How to use subscription data (CAC, LTV, gross margin expansion) to scale faster and safer

Let’s start with economics….

Ad costs are rising, fast. According to Meta’s latest earnings report, advertising costs have increased by around 10% this year alone, continuing a multi-year trend. In fact, estimates suggest that ad spend has become 50-60% more expensive over the past five years.

Why Rising Ad Costs Matter

In DTC, scale usually kills efficiency. The larger you grow, the more expensive your acquisition becomes, driving up your CAC.

That’s where the subscription model shines. Its repeatable nature gives it an enormous advantage over one-time purchase or low-repeat brands. Every repeat order stacks on top of the last, compounding LTV (Lifetime Value) over time.

The faster your LTV stacks, the more flexibility you have. You can afford to spend more to acquire a customer, grow faster, and still stay profitable.

The best DTC brands aren’t the ones with the lowest CAC, they’re the ones who understand that paid acquisition is an expensive game, and the brand that can endure the most CAC pain while maintaining margin is the one that wins.

The Ceiling of One-Time Purchase Economics

Let’s take a real-world example.

Say a mattress brand retails its product for $1,000 and operates at a 50% margin once it’s delivered to the customer. That means each sale generates $500 in gross margin before acquisition costs.

Now, suppose the brand acquires 20 new customers per month at an average CAC of $200.

Here’s what the math looks like:

- $1,000 retail price

- – 50% COGS → $500 gross margin

- – $200 CAC → $300 profit before operating costs

So far, so good.

But here’s the challenge, mattresses are a low-frequency purchase. Even with the best marketing in the world, you can’t convince people to buy another one every few months. If the average customer only repurchases every five years, the brand must be profitable on the first purchase.

That’s where the growth ceiling kicks in. If the brand’s gross margin is $500, that’s the maximum CAC they can afford before the economic collapse. Spend beyond that, and they lose money immediately, with no realistic path to recoup it through repeat sales.

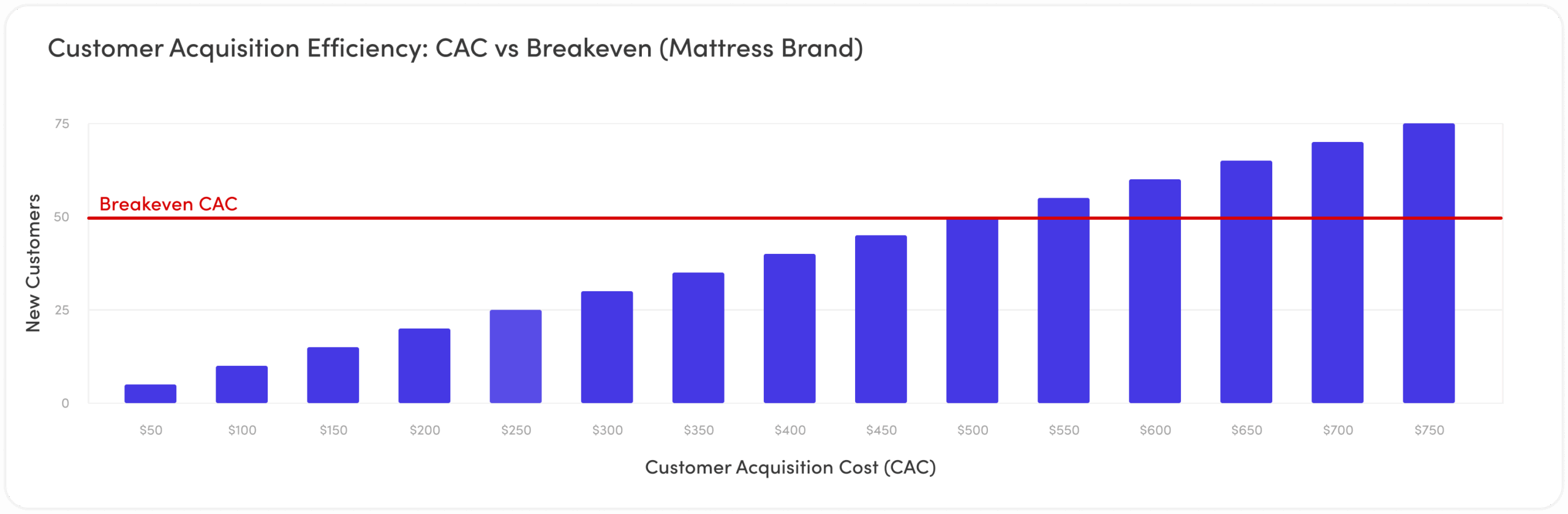

You can see this dynamic in the chart below. As ad spend increases, new customer volume (blue bars) rises, but so does CAC. Once CAC approaches the $500 breakeven line (red), the brand hits its limit. Beyond that, every dollar spent to acquire a new customer erodes profit instead of driving growth.

Why Subscription Brands Break the CAC Ceiling

In the mattress example above, we saw how growth can hit a hard ceiling, the brand can’t profitably scale beyond its CAC limit, because customers rarely come back.

If you’re still reading, you’re probably running, or at least curious about, a subscription-based DTC brand, and this is where things get interesting.

The beauty of the subscription model is that your CAC ceiling becomes virtually limitless. You’re not bound by a single purchase. Instead, every repeat order pushes your LTV (Lifetime Value) higher, extending how far you can profitably scale.

Before diving deeper, let’s make sure we’re speaking the same language:

- CAC (Customer Acquisition Cost) = Total marketing spend ÷ New customers acquired

- 1st Order Value = Gross margin per new customer (not revenue) — strip out all variable costs like product, packaging, shipping, and transaction fees

- CAC Payback Window = How long it takes for your cumulative gross margin from a customer to exceed the CAC you paid to acquire them

- Gross Margin Expansion % = The percentage increase in gross margin over a specific time period, driven by repeat purchases, upsells, or improved retention. This shows how effectively your customer base compounds over time.

Understanding these metrics is the foundation of sustainable growth for any subscription brand.

👉 If you want a deeper dive into this, check out our post on How to Measure Customer Lifetime Value: Calculate CAC Payback & Scale Profitably

Why Cashflow, Not CAC, Is the Real Constraint

But, and it’s a big but, while your CAC ceiling might be infinite, your cash isn’t.

What does that actually mean?

In theory, a subscription brand could afford to pay almost any CAC as long as the lifetime value (LTV) of the customer eventually exceeds it. If a customer stays subscribed long enough, you’ll eventually earn back what you spent to acquire them, and then some. That’s why subscription brands can scale far more aggressively than one-time purchase businesses.

The problem is timing. You still have to pay your ad platforms, agencies, and suppliers today, while that LTV comes in over months or even years.

That’s why CAC payback, the time it takes to recoup your acquisition cost through gross margin, becomes the single most important metric in your business.

If your payback window is short (e.g., 1–2 months), your cash recycles quickly. You can reinvest into marketing and scale confidently. If your payback window stretches to 6+ months, even if you’re profitable on paper, you’ll run into cashflow problems because you’re constantly spending money far faster than it’s coming back in.

In other words:

“You don’t go out of business because your CAC is too high, you go out of business because your cash runs out before your LTV catches up.”

The Two Extremes of Subscription Economics

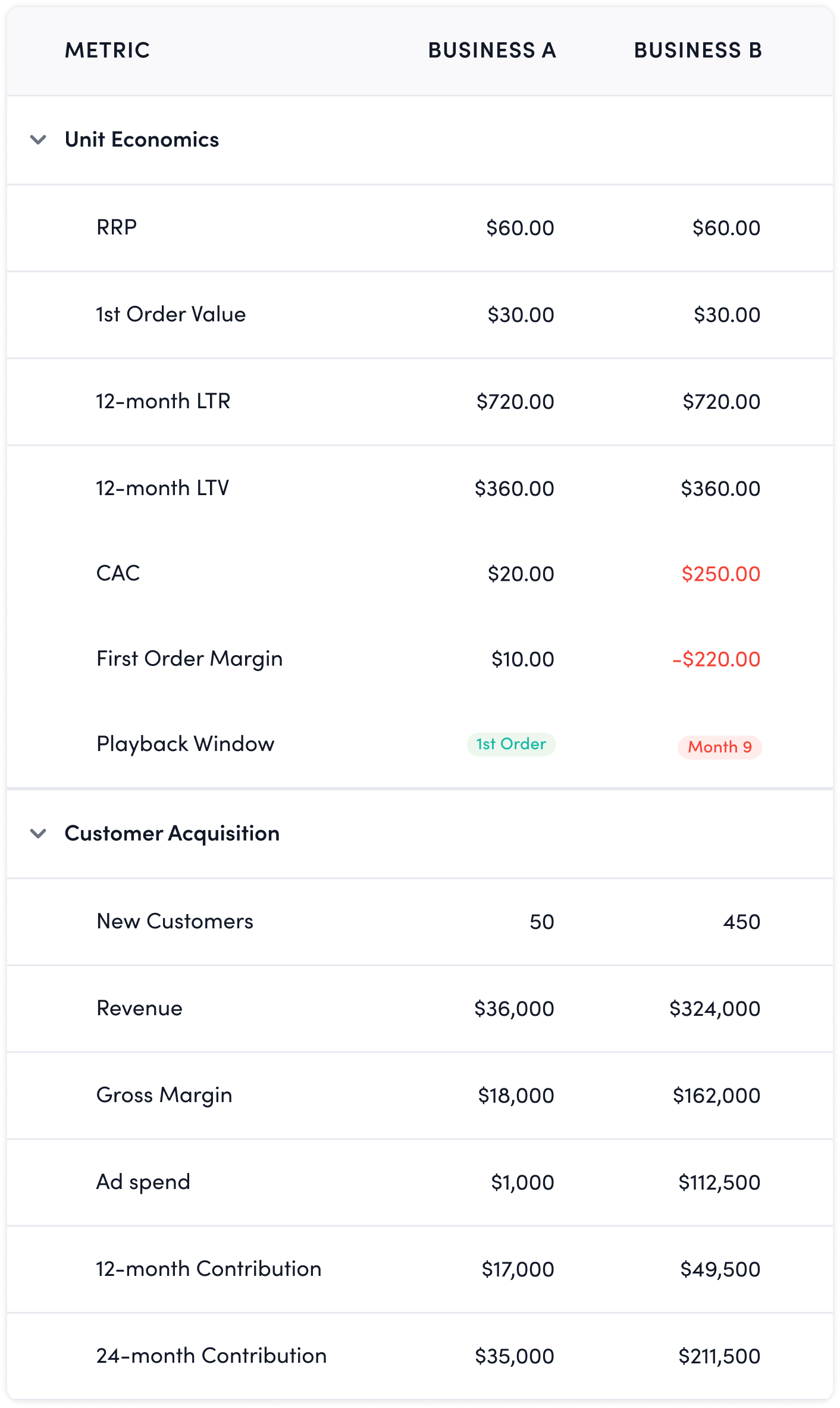

Let’s look at two subscription-based DTC businesses operating at opposite ends of the spectrum, one that’s highly first-order profitable, and one that’s not. Both sell the same product at the same price and margin, and both have identical retention (monthly purchases, 0% churn). Unrealistic? Sure. But it keeps the economics clean so we can focus on the real takeaway: what happens when one brand is willing to lose money upfront, and the other isn’t.

Before diving in, it’s worth remembering: we’re talking about cohorts, customers acquired in a specific month. For subscription brands, this is how you should think. Each new cohort represents a predictable, compounding revenue stream that layers on top of the last.

Business A: Playing It Safe

We see this type of business all the time. It’s cautious, understandably so. They’re first-order profitable, meaning they make money right away. Their CAC is just $20, generating a $10 profit on every new customer from day one.

But here’s the problem: that risk aversion is capping their growth. They’re hesitant to push spend because they don’t want to lose money on acquisition, but ironically, this caution is costing them huge profits in the long run. Let’s illustrate this below…

Business B: Playing the Long Game

Now, look at Business B. They’re spending $250 CAC, which puts them $220 in the red on the first order. Brutal, right? They won’t break even until Month 9.

In practice, that means they’re scaling at a $220 loss × 450 new customers = $99,000 upfront deficit, and they’re not seeing profit for nine months. Do that every month for a year, and you’d need a serious cash float to sustain it.

This is where CAC payback management becomes the single biggest skill in subscription DTC. The best brands know their numbers cold, not just LTV or ROAS, but how quickly each cohort pays back acquisition spend. Subscription, more than any other model, is a game of cashflow management.

But Here’s the Payoff

If you can stomach the short-term pain, the upside is enormous.

Business B wins because they were willing to do something most brands aren’t:

they accepted that first-order profitability isn’t the game in subscription DTC, stacking LTV and payback are.

By being comfortable going negative on the first order, Business B unlocked three advantages that Business A never will:

1. They could afford a higher CAC – and therefore access more scale.

As you spend more on paid social, marketing efficiency always drops (CAC up & ROAS down). It’s just how auction-based systems work. The more you scale, the more expensive customers become.

Business A caps themselves early because they refuse to take a loss upfront.

Business B has no such ceiling, their retention and payback window justify a higher CAC.

This means Business B can keep scaling into a more expensive CAC environment, while Business A is forced to slow down just when the opportunity is largest.

2. They capture more of the market earlier.

By outspending competitors, Business B simply buys more customers, more quickly. In subscription DTC, customers are assets, they produce value over months and years.

Business A’s caution creates a bottleneck.

Business B’s willingness to pay more accelerates market share acquisition.

3. Their cohorts compound harder, faster.

Every month that Business B adds a large new cohort, even if it’s unprofitable upfront, they’re adding a future revenue stream that compounds.

By Month 12, their contribution profit is already 3× higher.

By Month 24, nearly 7× higher.

And it keeps widening.

This is the heart of subscription economics:

The brand willing to pay more (sensibly) to acquire a customer almost always wins, because they scale faster and their margin compounds longer.

Want to model this for your own brand?

Download our free DTC Subscription Forecast Builder, the simple, powerful spreadsheet that lets you plug in CAC, payback, churn, and margin to see exactly how fast (and how profitably) you can scale.

👉 Download the Subscription Forecast Builder — Free

What Should You Actually Aim For?

That’s the million-dollar question, and the answer isn’t highest ROAS or lowest CAC.

In subscription ecommerce, those metrics are often red herrings. The goal isn’t efficiency, it’s velocity. You’re not trying to buy the cheapest customers; you’re trying to buy as many valuable customers as your cashflow can sustain.

The real levers to optimize are CAC, first-order margin, and CAC payback window. These three metrics dictate how fast you can scale, and how much pain your cashflow can endure while you do it.

Before you start tuning campaigns, step back and ask a more strategic question:

“What’s the role of my subscription business in the wider company?”

If it’s your hero product, the engine of your entire DTC model, then you have to be brutally honest about your cash position and forecast for the next 12 months. Because scaling subscriptions isn’t about hacking ROAS; it’s about managing the tension between growth ambition and cash discipline.

At StoreHero, across hundreds of scaling DTC subscription brands, we consistently see an average of 2–5 month CAC payback window as the sweet spot for high-growth operators. Anything shorter, and you’re likely leaving growth (and long-term profit) on the table.

If you’re consistently first-order profitable and you’ve got strong retention data showing steady gross margin expansion/ LTV growth, that’s a green light to push. Spend more. Be comfortable seeing your CAC climb. Yes, you’ll compress margins in the short term, but your compounding repeat revenue will more than offset it on the back end.

Conversely, if your CAC payback window stretches to 9–12 months, you’re in deep water. It’s not inherently bad, but you’d better have a damn good reason for it and the cash reserves to back it up. That playbook works for well-capitalized, VC-backed DTCs that can afford to delay profitability. For most bootstrapped brands, it’s a death sentence for cashflow.

The truth is:

Fast-scaling subscription brands don’t win because they have the lowest CAC.

They win because they control their payback window, they know exactly how much pain they can take, and for how long.

Get that balance right, and you’ll scale faster, safer, and far more profitably than the brand chasing vanity metrics.

Profitable Velocity Wins

Subscription is the ultimate endurance sport in DTC. The brands that win aren’t chasing the cheapest clicks or the prettiest dashboards, they’re obsessed with one thing: how fast they can turn spend back into cash. They know their CAC, their payback window, and exactly how much acquisition pain they can take while still compounding profit month after month.

The truth is, anyone can sell a product once. But the best operators build machines that buy customers today and earn from them for years. That’s the real power of the subscription model, profitable velocity, not short-term efficiency.

And with the stakes this high, understanding your unit economics isn’t optional. In fact, this is exactly why so many fast-scaling DTC brands eventually outgrow their accountant and bring in a fractional CFO who understands subscription unit economics, cashflow modelling, and cohort-based forecasting. (You can learn more about this shift in our post Why Most DTC Brands Outgrow Their Accountant | When to Hire an eCommerce CFO)

When you’re scaling subscriptions, you’re not managing a P&L, you’re managing time, cashflow, and compounding. You need someone in your corner who sees past ROAS and revenue, and into retention-driven gross margin expansion, payback velocity, and CAC ceilings.

StoreHero helps DTC and subscription ecommerce brands centralize their performance, marketing, and profit data — making it easy to track CAC payback, LTV, and margin expansion in real time. It’s the operating system for brands that want to scale fast and profitably.

CAC only tells you what it costs to acquire a customer, it doesn’t tell you whether that cost is healthy for a subscription business. What matters is how fast that customer pays you back through first-order gross margin and repeat subscription revenue.

Without knowing your payback window, you can’t tell if a CAC is good or bad.

A “cheap” CAC with slow payback is worse than an “expensive” CAC that pays back quickly.

For subscription brands, payback is everything, it determines how fast your cash returns and how aggressively you can scale.

- <1 month = extremely strong (but you’re likely under-spending)

- 1–3 months = ideal scaling range

- 4–6 months = requires strong cash reserves and retention

- 7–12+ months = dangerous unless you have major capital backing

Anything beyond 6 months puts real strain on cashflow unless the brand is highly capitalized. For bootstrapped or lightly funded brands, 9–12 month payback windows are often a red flag, you run out of cash before your LTV catches up.

Rising ad costs reduce efficiency, increasing CAC. One-time purchase brands hit a hard ceiling because they must stay profitable on the first order. Subscription brands, however, have recurring gross margin that compounds, allowing them to afford higher CAC and scale through periods where ad costs spike.

Because they earn back margin repeatedly and predictably. Each monthly order expands LTV, which increases the maximum CAC they can pay while staying profitable. This means subscription brands can outbid competitors, capture market share earlier, and scale even when acquisition becomes more expensive.

Not necessarily. Many of the fastest-growing subscription brands purposely lose money on the first purchase because they recoup CAC quickly through repeat orders. First-order profitability is helpful but not required, what matters most is the payback window and cashflow management.

The core metrics that matter are:

CAC

1st Order Gross Margin

CAC Payback Window

LTV (Gross Margin LTV, not revenue LTV)

Retention / Churn

Gross Margin Expansion % by cohort

Contribution Margin

These determine how fast, how safely, and how profitably you can scale.

Gross margin expansion is the increase in cumulative gross margin from a customer or cohort over time. In subscription DTC, this is essential, every repeat purchase widens your margin, enabling you to pay a higher CAC and scale more aggressively without sacrificing profitability.

LTV measures the total gross margin a customer generates over their entire lifecycle.

CAC payback measures how long it takes for the cumulative gross margin to recover the acquisition cost.

LTV tells you if a customer is profitable.

Payback tells you if you can afford to scale.

Not really. Without strong retention, subscription becomes a disguised one-time purchase business — and the economics fall apart. Churn kills LTV. Without LTV, you can’t tolerate higher CAC. Without higher CAC, you can’t scale. Retention is the backbone of any subscription model.

If your CAC payback window is under 30 days, you’re almost certainly underspending. Brands with extremely short payback windows usually have room to scale harder, and leaving that opportunity on the table slows down long-term compounding.

StoreHero centralizes your marketing, performance, and profit data into a single view — giving you real-time visibility into:

CAC payback

Cohort-level margin expansion

Retention curves

Contribution margin

Forecasts

Unit economics

It’s the operating system for subscription brands that want to scale with speed and profitability.