TL;DR 3 Levers for Margin Expansion

- DTC profitability isn’t just about ad hacks, it’s about margin structure.

- Improving gross margin gives you more room for scaling paid media.

- Store credit, shipping thresholds, and return policies are simple levers to boost profitability fast.

Too many brands obsess over the next ad hack, attribution tweak, or CRO trick, pouring endless time and money into the marketing side of the equation. Growth ceilings are rarely set by ads. They’re set by margin, and that’s the foundation of DTC profitability. If your gross margin doesn’t give you the firepower to afford rising customer acquisition costs, no amount of creative testing will unlock scale. And that’s where the real growth lever sits, inside your offer structure.

For me, it all comes down to designing an offer that gives you enough margin to afford the CAC required to hit real scale. The goal isn’t to drive CAC as low as possible. In fact, hyper-growth almost always comes with a higher CAC – it’s expensive to win big. The best brands know this, and they’ve built their business model to support it.

The problem? Most brands don’t think about it this way. So in this article, I’ll break down the direct link between gross margin and your allowable marketing spend, plus three levers you can pull right now to boost your margins – and set yourself up for real, scalable growth.

To show just how much gross margin can impact a business, let’s use a real example from a brand I spoke with last week. But before we get into that, let’s make sure we’re on the same page about what “gross margin” actually means in DTC.

What Gross Margin Really Means in DTC

At its simplest, gross margin is your Net Sales (that’s after stripping out sales taxes or VAT) minus your fully loaded COGS. And fully loaded really means fully loaded. At its simplest, gross margin is your Net Sales minus fully loaded COGS. And here’s one of the most overlooked gross margin tips: always include discounts, BNPL solutions, shipping, and returns, not just product costs!

This business started with what looked like an 80% product margin. But once you factor in free shipping on orders just above their AOV, free returns, instant refunds, 3PL fulfillment fees, and the cost of buy now pay later options, that margin shrinks fast. In reality, their 80% product margin translated into only 40% fully loaded gross margin/ 60% COGS. Check out our blog, The Brand Founder’s Guide to Improving Margins

The Hidden Link Between Gross Margin and Growth

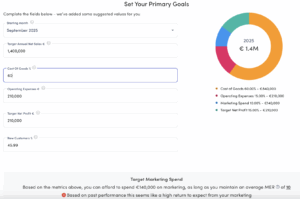

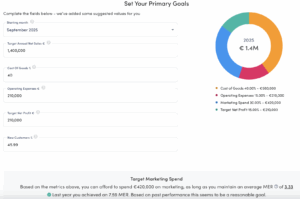

The business wanted to aim for Net Sales over the coming 12 months of €1.4m, with a net profit of €210,000. Once we include their operating costs to run the business of €210,000, this means that all that was left over for them to spend on marketing was going to be €140,000 meaning that they would need an MER of 10 – we all know this was going to be too high.

The founders set a clear objective: improve fully loaded gross margin from 40% to 60%, in other words, reduce COGS from 60% down to 40%. That’s a big shift, but it effectively boosted their gross margin by 50%.

So what did that mean in practice? Instead of having just €140,000 available for marketing, they now had over €420,000 to spend, that’s the power of margin optimization in DTC profitability. Their MER target dropped from 10 to 3.33. And here’s the key point: sales and profit projections stayed exactly the same. Nothing changed except the offer structure – yet suddenly they had far more firepower in ad spend to hit the same goals.

Why Conversion Tactics Can Erode Margin

The founders were initially hesitant to raise free shipping thresholds, charge for returns, or cut expensive BNPL options, after all, these perks do help with conversion. But the question is: at what cost? Each of these tactics chipped away at gross margin, which in turn forced their ads to work exponentially harder just to deliver the same results.

Once they restructured their margin strategy, the effect was dramatic: their available marketing budget nearly tripled, giving them far more room to scale paid media profitably without changing their sales targets.

So, what levers did they pull?

Three Levers to Boost Margin Right Now

Store Credit Instead of Refunds

Issuing store credit rather than cash refunds keeps revenue within the business and drives repeat purchases. Instead of money leaving your balance sheet, customers are directed to spend again with you – supporting higher lifetime value and profitability.

Data shows that 68% of customers make another purchase after receiving store credit, resulting in stronger repurchase rates and higher average order values compared to standard refunds.

Store credit doesn’t just offset a return – it converts a potential loss into another sale and keeps revenue circulating in your business.

Free Shipping Thresholds

A practical benchmark is to set your free shipping threshold around 20% above your average order value (AOV). This ensures most customers don’t automatically qualify, making free shipping an incentive rather than an expectation.

Free shipping is never truly free—it’s a direct cost. For example, if your CAC target is €30 and shipping costs €6, that’s already 20% of your CAC consumed. Raising the threshold helps protect margin and increases your allowable CAC, which creates more room to scale.

When combined with strategic upsells—especially lower-priced add-ons in the cart or at checkout—you can lift AOV, improve margin, and expand growth potential.

Rethink Free Returns

Free returns remain common, but even larger retailers like ASOS have moved away from them. The reason is straightforward: the cost quickly adds up.

Breakdown of a single return order:

- Outbound shipping: €6

- Return shipping: €6

- 3PL fulfillment: €2.50 outbound + €2.50 restocking

- Non-refundable transaction fees: ~€3

Total loss: ~€20 per return when the customer doesn’t repurchase.

In apparel, with return rates of 20–30%, this creates a significant drag on profitability.

The impact:

- ROAS figures appear inflated.

- Margins shrink.

- Scaling becomes harder.

Charging for returns may slightly reduce conversion rates, but it also filters for higher-quality customers and protects margin. Stronger margins allow for a higher CAC threshold, which in turn gives paid media more room to perform.

When brands focus only on reducing friction at checkout while ignoring margin erosion, they force ads to carry the entire burden of growth. It’s an unsustainable approach – and a common trap.

The Bigger Picture: Scaling with Margin Power

Scaling isn’t just about buying cheaper clicks or a better ROAS, it’s about building the margin foundation to afford growth. By rethinking refunds, shipping, and returns, you’re not just protecting margin, you’re multiplying your marketing firepower. That’s how the best DTC brands win big in 2025.

👉 If you want to stress-test your margins and see how much more firepower you could unlock for growth, book a StoreHero demo.

How to Measure Customer Lifetime Value & CAC Payback Period

October 13, 2025[…] this is just one part of the profitability puzzle. If you want to go deeper, check out our blog: 3 Proven Levers to Unlock Margin Expansion, where we break down additional ways DTC brands can expand margin and protect […]

The Problem with ROAS: why it's blocking your Shopify growth - storehero.ai

October 13, 2025[…] Despite a 3X ROAS, this campaign only made $200 in actual profit—a slim margin. If costs were slightly higher, this campaign could be unprofitable. Check out our blog on the 3 Levers for Margin Expansion. […]

Hailee Hintz

October 20, 2025Your blog has quickly become my go-to source for reliable information and thought-provoking commentary. I’m constantly recommending it to friends and colleagues. Keep up the excellent work!