Accurately manage your VAT calculations with our Add and Subtract VAT Calculator. Quickly calculate VAT for any amount with ease.

"*" indicates required fields

"*" indicates required fields

Adding VAT: VAT (Value-Added Tax) is calculated by multiplying the price of a good or service by the VAT rate. For example, if the VAT rate is 20% and the price of a good is €100, the VAT would be €20 (€100 x 0.2). This means that the total cost of the good including VAT would be €120 (€100 + €0).

Deducting VAT: To calculate the VAT exclusive price (also known as the net price) from the VAT inclusive price, we need to use the following formula: VAT exclusive price = VAT inclusive price / (1 + (VAT rate / 100)). For example, if the VAT inclusive price is €120 and the VAT rate is 20%: VAT exclusive price = €120 / (1 + (20 / 100)) = 120 / 1.2 = €100. In this case, the VAT-exclusive price is 100 euros. And the VAT amount is €20 (120 – 100).

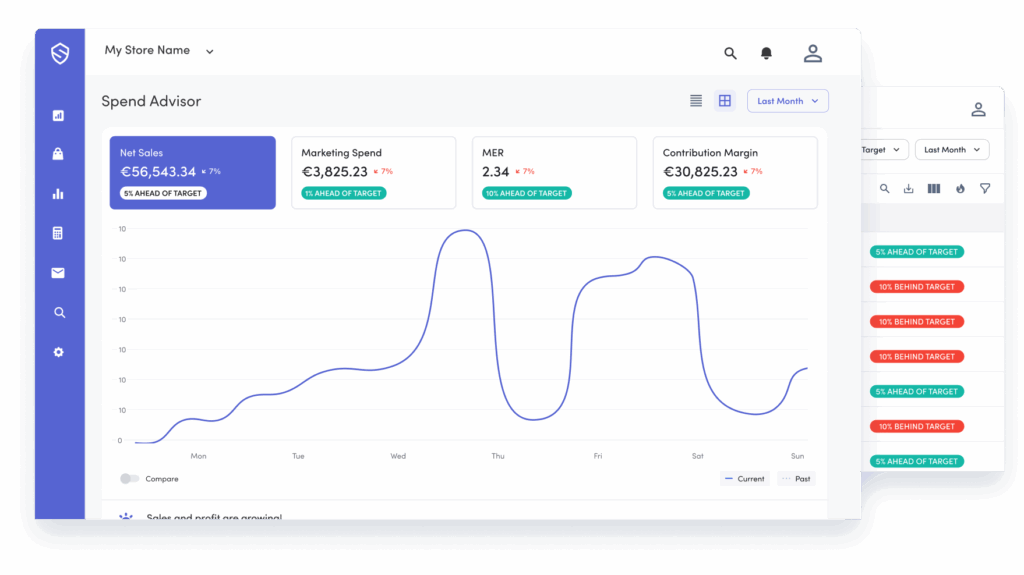

Get a demo and see how our unified e-commerce dashboard can help grow your store, profitably.