Maximizing Customer Lifetime Value” is key for businesses to sustain and grow in the long term. Calculating the LTV/CAC ratio and monitoring it over varying “lifetimes” can inform customer acquisition and retention strategies. The contribution value helps understand the actual value of each customer.

It’s not just about revenue, but the gross profit derived from each customer over their lifetime. By focusing on LTV, businesses can make informed decisions about how to acquire and retain customers, and ensure they are generating enough value to sustain and grow their business in the long term.

The LTV/CAC ratio is a comparison between the value of a customer and the cost to acquire them. If the ratio is less than 1.0, the business is losing money, but if it is above 1.0, the company is making money. When calculating LTV/CAC, it’s important to define what “lifetime” means for your business.

Depending on the nature of the brand in terms of industry and how long you’ve been around, it can be interesting to monitor these ratios over varying “lifetimes” such as:

- Actual total lifetime

- 3 years

- 1 year

- 6 months

- 90 Days

By doing so, businesses can get a better understanding of how their LTV/CAC ratio changes over time, and adjust their customer acquisition and retention strategies accordingly. This allows businesses to stay agile and adapt to changes in the market, ensuring that they are generating enough value from each customer to sustain and grow their business over the long term.

When calculating the Customer Acquisition Cost (CAC) for an ecommerce business, it’s important to note that this is not the same as Cost Per Acquisition (CPA) or Cost Per Order (CPO). Rather, CAC represents the cost per customer acquired, assuming that you are paying for the customer rather than the CPA (cost per order). This may seem counterintuitive since many customers may be acquired through multiple CPAs, but calculating CAC allows you to measure the cost of acquiring a certain group of customers over a specific period of time.

Maximizing Customer Lifetime Value is crucial for businesses to sustain and grow in the long term. In order to accurately determine the value of each customer, it’s important to calculate the Contribution Value by taking lifetime revenue and subtracting costs like Product Costs, Transaction Fees, Fulfillment Fees, Shipping Fees, and Taxes from the Lifetime Revenue. This value represents the true contribution margin of the customer and is the “V” in the CLV ratio.

The ideal range for the LTV/CAC ratio is between 3 to 5. For example, if it costs €50 to acquire a customer, but that customer brings in €150 in value over their lifetime, then the LTV/CAC ratio would be 3.0. By optimizing their LTV/CAC ratio, businesses can ensure they are not overspending on customer acquisition and are generating enough value from each customer to sustain and grow their business.

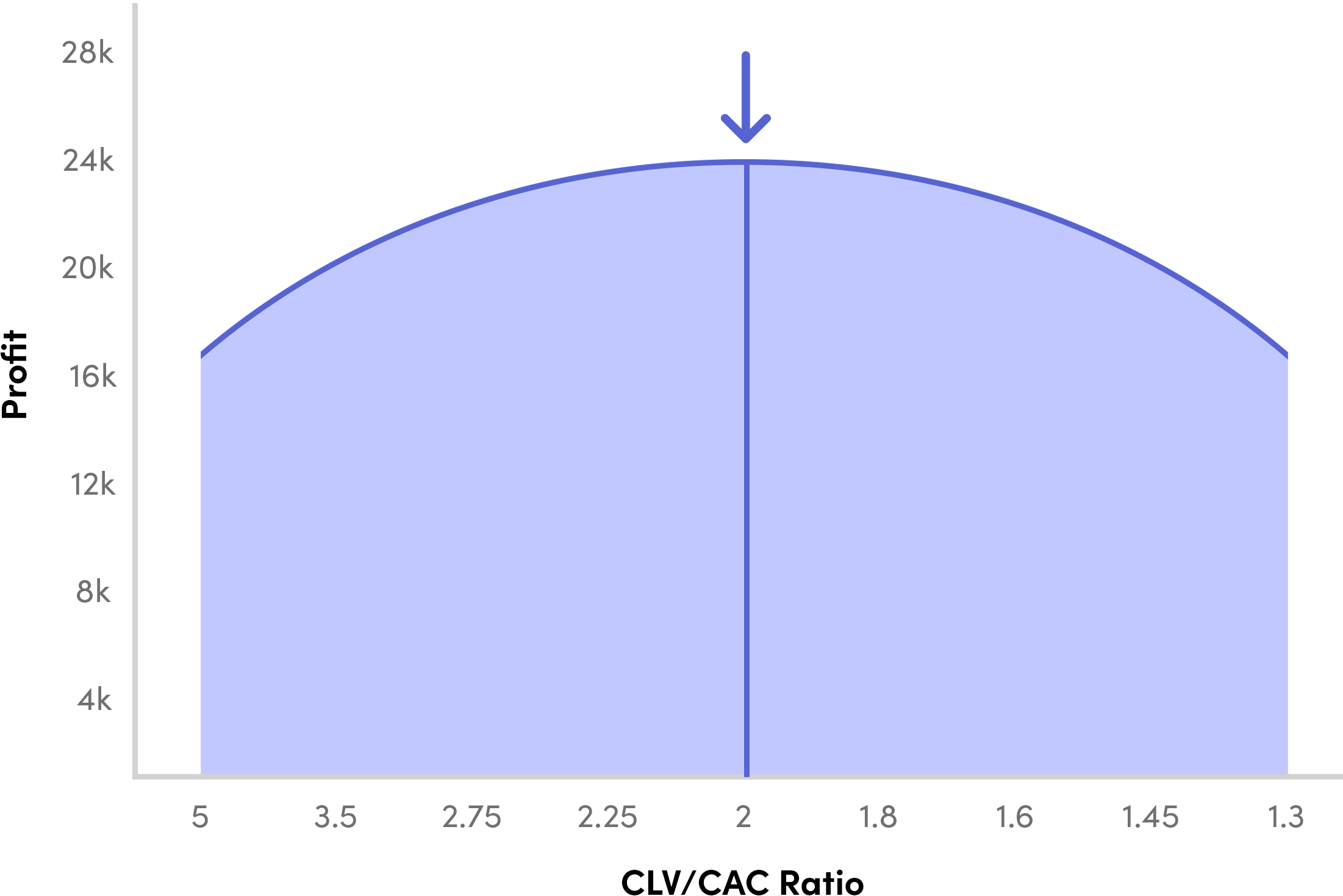

Maximizing profits by finding the optimal CLV/CAC ratio.

CLV and CAC are important for businesses. They’re the real metrics that show revenue and costs, but they’re measured at different times. CLV happens all the time, tracking sales and variable expenses for each order. CAC only happens when you get a new customer, measuring how much you spend on marketing to get them. So, when CLV is more than CAC, you make money from each new customer. But just going for the highest CLV/CAC ratio isn’t always the best way to make the most profit.

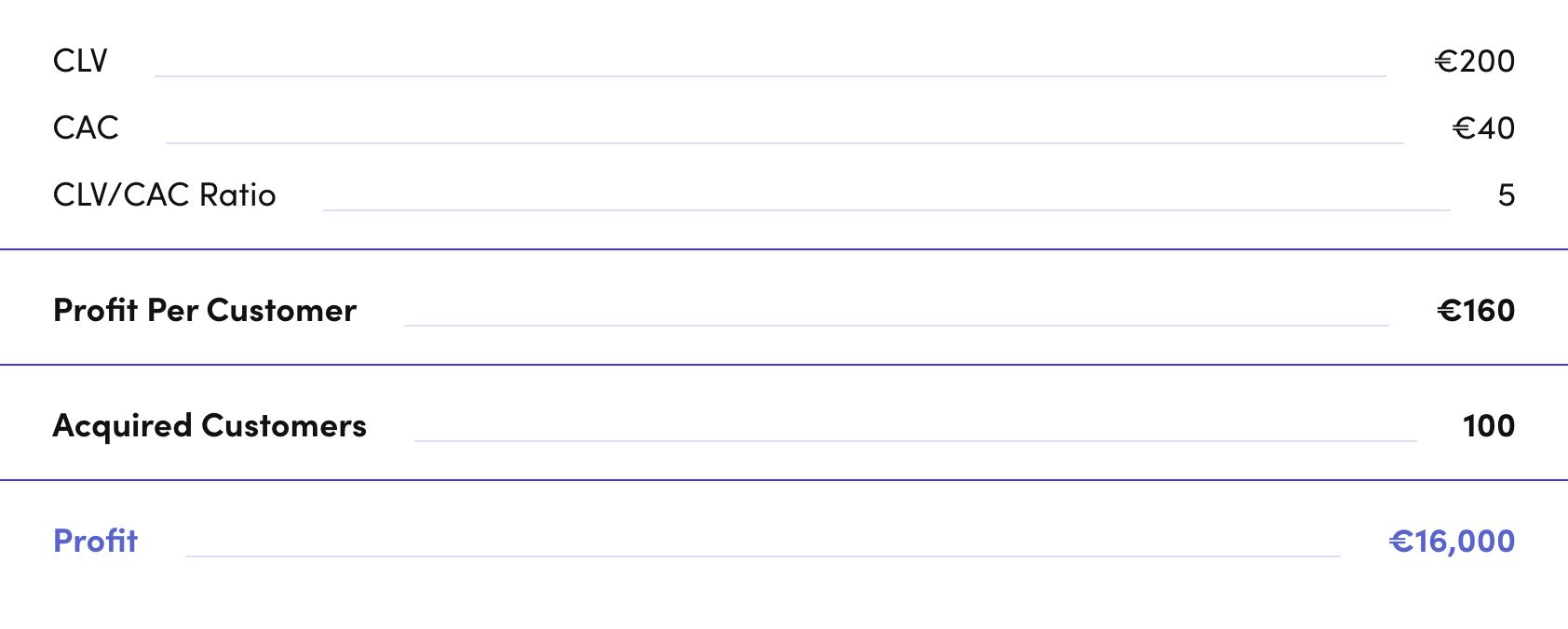

Let me explain. Let’s consider a scenario in which a business is generating €16,000 in gross profit from 100 customers, resulting in an LTV of €160, a CAC of €40, and a CLV/CAC ratio of 4. While this may seem like a profitable situation, it doesn’t necessarily mean the business is operating at optimal efficiency.

If the business increases their marketing spend to acquire more customers, their CAC will also increase. While it may be tempting to aim for a high LTV/CAC ratio, it’s important to keep in mind that higher isn’t always better. In fact, investing more to decrease CAC may actually be more beneficial for the overall profitability of the business, as counterintuitive as that may seem.

This is assuming a perfectly correlated relationship between the growth in customers and the growth in CAC, increasing the number of customers you want to acquire by 10% will lead to a 10% increase in the average CAC for all customers.

Many business owners are hesitant to increase their marketing spend due to the fear of rising CAC. However, investing more to decrease CAC can ultimately result in greater profitability for the business. In fact, understanding LTV:CAC on a contribution margin level is one of the most important KPIs for growing a successful ecommerce brand in 2023.

CLV/CAC Ratio by Absolute Profit

While it’s important to find the perfect CAC target, it’s not just about maximizing the CLV/ CAC ratio. You also need to think about the context of your business, like how much you make from each sale, and how your marketing spend affects your CAC. And if you make most of your money from customers after their first purchase, you have to take that into account when you calculate your CLV/CAC ratio.

For example, if the business increased its CAC to €100, they could acquire 250 customers per month, resulting in a CLV/CAC ratio of 2 and a profit per customer of €100, a decrease of 37.5%. However, the total amount of profit they could generate is up to €25,000, a 56% improvement.